China is already the world’s biggest industrial robot market in terms of sales volume, overtaking Japan. More than three quarters of the industrial robots sold in China were made by overseas brands.[Photo/Provided to China Daily]

Cutting-edge innovation vital for long-term success of Chinese firms

Though rising wage costs and growing competition have fueled an explosive growth in China’s use of industrial robots, it has been a season of disappointment for domestic firms as they continue to lag overseas manufacturers in the innovation race.

According to experts, with several industries such as manufacturing, logistics and telecommunications turning to robotics, aspects like the right technology and innovation can often be the differentiator between success and failure.

“The industrial robot industry in China is at least a decade behind the West,” said Wang Tianmiao, head of the robotic research institute at the Beijing-based Beihang University.

German and Japanese companies already have a head start over others, while companies from the United States are fast catching up with their innovative strides, Wang said.

“The low levels of robot development and the manufacture of key components used in robots, such as decelerators and motors, are hampering growth of ‘made-in-China’ industrial robots,” he said.

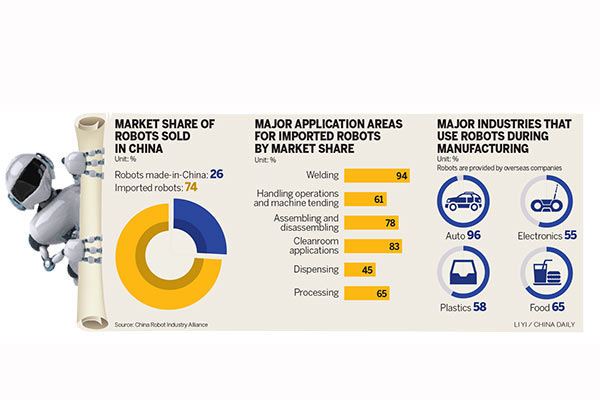

More than three quarters of the industrial robots sold in China were made by overseas brands last year, said a report published by the China Robot Industry Alliance.

Welding was the largest application area for imported robots, with their market share standing at 94 percent in this segment last year. Handling operations and the machine tending accounted for about 60 percent of the market, the CRIA said.

According to experts, domestic robot makers will have a bigger say in the market in future as overseas companies, which usually focus on high-end customers including auto-makers, will not be able to cater to the growing demand from other sectors.

Hunan-based Changsha Chaint Robotics Co Ltd is one of the few Chinese companies that make robots for the automobile assembly industry.

Yang Yang, managing director of the company, said he remains optimistic on future prospects due to the growth momentum provided by the fast growing auto industry.

Imported robots used to be the mainstay for most of the automobile companies in China. But with demand surging, many local companies, like Chaint, are getting orders from top-end companies such as the China subsidiary of General Motors, Geely Holding Group and the nation’s leading high-speed train maker CSR Co Ltd, Yang said.

The company is expected to post annual sales volume of more than 200 million yuan ($327,869) this year, compared with an annual turnover of 160 million yuan in 2013.

China is already the world’s biggest industrial robot market in terms of sales volume, overtaking Japan. The CRIA said a fifth of global industrial robots, or 36,860 units, were sold in China in 2013. Annual shipments jumped by more than 40 percent year-on-year last year.

Overseas vendors increased their sales by 18.6 percent compared to a year ago while Chinese companies grew their shipments by five times, said the CRIA report.

Sun Lining, president of Suzhou Boshi Robotics Technology Co Ltd, is also optimistic about the future.

“German and Japanese vendors may be the dominant players in the automobile manufacturing sector. But they will not be able to cover thousands of other industries that need robots in lieu of human capital,” Sun said.

Boshi, established in 2009, mainly produces glaze-spraying robots for high-end bathroom supplier makers. Unlike automobile assembly, glaze-spraying robots have lower precision requirements but similar reliability.

“Chinese companies must acknowledge the technology gap with global industry leaders and focus more on showcasing their strengths. They should concentrate on the lower-end of the market and build up scale to challenge overseas players,” Sun said.

Boshi is looking at turnover of 100 million yuan ($16 million) in the next two years, he said, adding that the company is working on next-generation products that are capable of undertaking more sophisticated jobs.

While companies mull various strategies to tap the market, there is no doubt that it is China’s role as the world’s factory that is paving the way for wide usage of industrial robots. That also explains, to some extent, why most of the leading global robot makers are focusing on automobile assembly and other high profit margin industries.

Buyers of less-sophisticated robots, including small commodity makers, logistics companies and electronic equipment vendors, are target customers for Chinese companies, experts said. With human capital costs increasing in China, many industries are turning to robotic product lines to save costs. High productivity and quality are other factors that are prompting more Chinese companies to use robots, instead of actual workers.

“If the cost of buying a robot is lower than the workers’ salary, most company owners will use machines rather than humans. It’s really simple mathematics for them,” said Sun.

Terry Gou, founder and chairman of Taiwan-based Foxconn Technology Group, said last month that robots “are an important means to restructure labor resources”.

Foxconn, the world’s largest contract electronics manufacturer, said it hopes to free workers from tedious manual labor by ratcheting up automation in production. The company launched a “robot strategy” in 2010, aiming to put millions of robots into use. Some of its robotic arms have already been put into use in factories on the Chinese mainland. However, the company also hires about 1 million workers for making popular consumer electronic devices like Apple Inc’s iPhone 6 and 6 Plus.

Xu Xiaolan, secretary-general of the Chinese Institute of Electronics, said the government is supporting the robotics push, as China needs to replace several outdated industries and manufacturing techniques to sustain growth in the long term.

“More favorable policies and subsidies for robotics are likely next year, especially to boost innovation,” Xu said.

“The government should make sure that the investment goes to the right research areas-the ones that bottleneck local manufacture of robots.”

Xu said Chinese companies should look at overseas markets for growth, as other developing markets will also face problems like surging labor costs.

Wang Weiming, deputy director of the equipment department under the Ministry of Industry and Information Technology, said the government is considering a 13th Five-Year Plan (2016-20) for industrial robots. The development plan is expected to lift growth prospects for local companies once the policies and funds are put in place.

Most of the current subsidies for robotics companies come from local governments. “There is no doubt that the industry needs a clear, long-term strategy. It should map out the long-term goals and allow the market to work out the modalities,” Xu said.

The young industry needs government support as well as social investment, said Wang from Beihang University.

“The industry is particularly attractive for Chinese investors because of the huge market potential. Venture capitalists will be more than willing to set up incubators for startup robot companies,” he said.

Chinese robot suppliers sold nearly 9,600 industrial robots last year, representing roughly 1 billion yuan in sales value, said the CRIA report. Food, beverages, daily commodities, pharmaceuticals and material manufacturing were the hottest sectors for made-in-China robots.

Experts said the government should invest more in frontier robotic research while supporting commercial robot development by local companies.

“Looking forward, the robot-making industry should fully embrace the ideas of market competition so that home-brands will become more technologically competitive in the long run,” Wang said.

Tang Qingmei in Changsha contributed to this story.