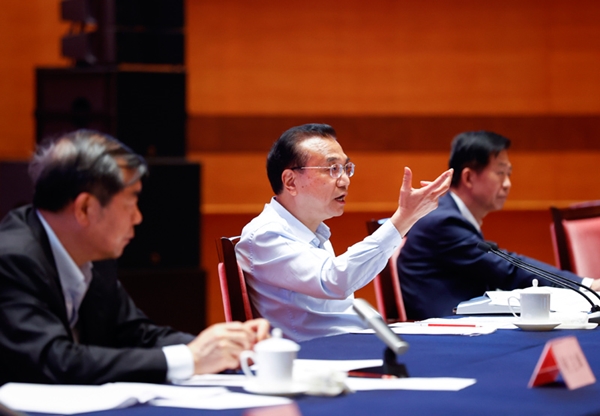

Premier Li Keqiang held a video conference on June 1 in the northern port city of Qingdao during an inspection to East China’s Shandong province, where he urged efforts to establish a strict regulatory mechanism to ensure new fiscal funds go straight to city and county governments and directly benefit businesses and people.

The Party secretary and acting governor of Shandong, governors from Zhejiang, Anhui, Guizhou and Shaanxi provinces, representatives from Jining city and Yiyuan county in Zibo city of Shandong, and deputies from enterprises involved shared their opinions and offered suggestions during the video conference.

They agreed that the newly added fiscal funds directly allocated to grassroots levels will satisfy the urgent needs of people, and will serve as the "timely rain" for relieving some of the financial burdens of governments at city and county levels.

Premier Li said the Government Work Report adopted by the National People’s Congress focuses on ensuring six priorities and stability in six key areas, increasing fiscal deficits and issuing tailor-made epidemic-prevention bonds totaling 2 trillion yuan ($279.71 billion), which was an important part of policies of a sizable scale for providing relief to businesses and revitalizing the market. The fiscal funds are to be mainly used for ensuring employment, people’s basic livelihood and market entities.

As the specific policies issued in a special period, the new fiscal funds will go straight to city and county governments and directly benefit businesses and people. More focus will be put on helping enterprises, and taking advantage of market forces to stabilize the economic fundamentals. That is an innovation for macro control mode, according to the Premier.

He underlined the new fiscal funds were mainly applied to help micro, small and medium businesses and self-employed individuals, low-income groups including migrant workers, flexible workers and service staff, and vulnerable groups covering those living in poverty, on minimum subsidies, receiving temporary assistance, and the unemployed. They were affected more by the pandemic and involve hundreds of millions of people.

A special transfer payment mechanism should be set up to ensure that funds go straight to primary-level governments and directly benefit businesses and people and that no such funds are allowed to be withheld by provincial governments, Premier Li said.

He also urged fiscal departments to clarify the financial support policies and the scope of application, while city and county governments were required to identify the enterprises and individuals in difficulties as soon as possible, establish real-name accounts and make sure the funds are in place.

The precious capital should be used within a stringent regulatory mechanism, the Premier said, calling for close attention and coordinated supervision from all parties.

The fiscal system should create records tracking the use of the government bonds for COVID-19 control to make sure that the money flow is clear and traceable. Treasury departments at different levels should directly transfer funds on a targeted and real-name basis, with accounts matching the realities. Auditing and related departments should regard the use of new fiscal funds as a focus in the audits.

Stronger fiscal and economic discipline should be enforced so that irregularities such as faking accounts and embezzlement are handled.

This is a reform that will affect the interests of some departments, but it must be done in the interest of the people, the Premier said.

Also, in order to benefit enterprises directly from measures such as waiving and reducing social insurance charges on a larger scale and pushing financial institutions to properly give up part of their profits, a mechanism should be in place as soon as possible, he said.

Local governments at each level must assume responsibilities within their jurisdictions, Premier Li said. Provincial governments should adjust the mix of spending, delegating more financial resources to primary levels. City- and county-level governments should plan fiscal expenditure scientifically through coordinated use of transfer payments from superior levels and their own financial resources. They must bear in mind the public nature of government funds and channel them into areas prioritizing people’s livelihoods whenever necessary.

Meanwhile, all levels of governments should implement tax and fee cut policies for enterprises, and avoid burdening them with arbitrary charges on the grounds of addressing fiscal revenue-expenditure imbalances, he added.

In the face of unprecedented difficulties and challenges, governments at various levels should take solid steps to push forward socio-economic development targets and tasks set out in the Government Work Report, as required by the Communist Party of China Central Committee and the State Council, Premier Li said.

That means implementing regular epidemic prevention and control, ensuring the six priorities and stability in the six key areas and attaining economic growth with stable fundamentals.

State Councilor Xiao Jie and He Lifeng, head of the National Development and Reform Commission, also attended the conference.