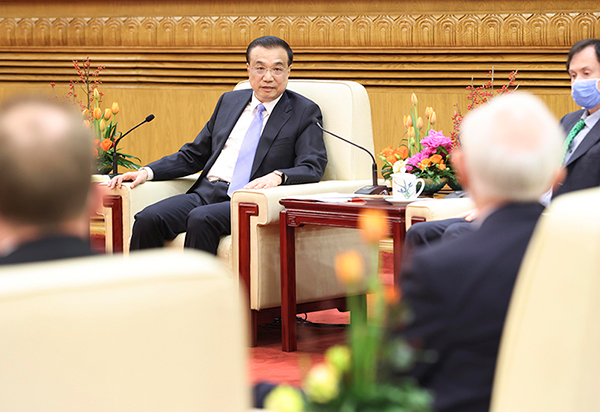

At a symposium with foreign expert representatives working in China held at the Great Hall of the People in Beijing on Feb 2, Premier Li Keqiang underscored China’s massive market potential for investors, with its large population and an ever-growing economy.

Michael R. Powers, an American professor from the School of Economics and Management at Tsinghua University, suggested that China should absorb advanced international experience and develop a multi-level capital market, to improve financial risk management.

As a developing country, China still has a long way to go in modernization, and its development needs and must have financial support, Premier Li said, adding that China should boost its capital market and develop multiple financial products.

The Premier stressed both macro-level financial stability and adoption of useful international experience, in order to foster a stronger capital market, promote the insurance industry, and cultivate a sense of long-term investment in small investors. Balanced financial risk management is also required in the process, in which China still has a long way to go.

China will further promote reform and opening-up in the process of modernization, Premier Li said, and stressed that the key to reform is to have the market play a decisive role in resource allocation and let the government also play its role.

Making a shorter negative list to attract more foreign investment is an important part of opening-up, the Premier said.