Vice-Premier Ma Kai (C, front) and other delegates pose for a group photo as attending the 21st APEC Small and Medium Enterprise (SME) Ministerial Meeting in Nanjing, East China’s Jiangsu province, Sept 5, 2014. [Photo/Xinhua]

Vice-Premier Ma Kai has asked local authorities to implement the central government’s latest financial services policies in an effort to support real economy.

Ma called for combined efforts to reduce financing cost of small firms and realize coordinated development of the financial sector and real economy during his visit in East China’s Jiangsu province on Sept 5.

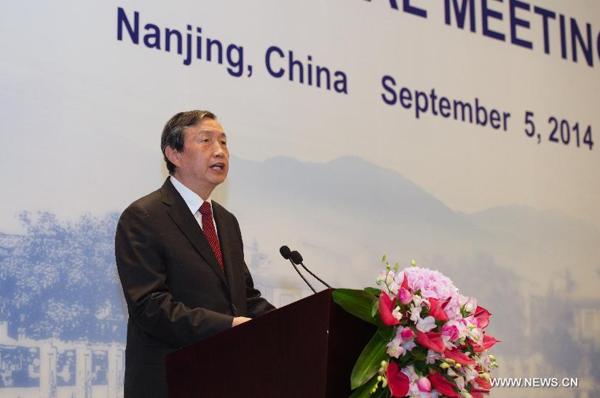

Vice-Premier Ma Kai addresses the opening ceremony of the 21st APEC Small and Medium Enterprise (SME) Ministerial Meeting in Nanjing, east China’s Jiangsu province, Sept 5, 2014.[Photo/Xinhua]

He hopes small firms will feel notable changes in financing cost reduction and access to loans.

Cutting financing cost for a real economy has significant meaning in stabilizing economic growth, structural adjustment and reform, as well as improving people’s livelihood, he said.

China has carried out an array of policies including tax breaks and cuts of the required reserve ratio (RRR) for certain banks to stimulate real economy in the first half of 2014 in pursuit of reform and sustained economic growth.

Ma pledged to maintain prudent monetary policy with proper and timely fine-tuning measures to make credit and social financing grow moderately.

Delegates attend the 21st APEC Small and Medium Enterprise (SME) Ministerial Meeting in Nanjing, east China’s Jiangsu province, Sept 5, 2014. [Photo/Xinhua]

He urged local governments and financial institutions to genuinely conduct targeted RRR cuts and increase re-lending to agriculture and small businesses.

He asked authorities to strengthen supervision over bank’s investment products and interbank borrowing, streamline service fees and improve efficiency of approving loans.

Internet technologies including big data and cloud computing should be used in guarantee institutions, and the financial system reform should be advanced to defend risks, he said.