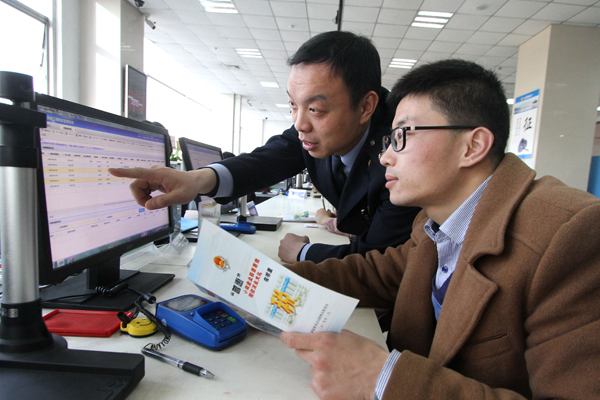

A staff (L) explains to a taxpayer about a new policy on VAT reduction at a local tax bureau in Yongnian district of Handan, North China’s Hebei province, April 1, 2019. Starting on April 1, companies that are subject to the 16 percent VAT rate on their taxable sales or imported goods will enjoy a 13 percent VAT rate, while those who are subject to the 10 percent VAT rate will only need to pay 9 percent, reads a Ministry of Finance statement.[Photo/Xinhua]

A staff (R) explains to a taxpayer about a new policy on VAT reduction at a local tax bureau in Fengze district of Quanzhou, East China’s Fujian province, April 1, 2019.[Photo/Xinhua]

(A staff (back) offers service to a taxpayer at a tax bureau in Kaili of Qiandongnan Miao and Dong autonomous prefecture, Southwest China’s Guizhou province, April 1, 2019. [Photo/Xinhua]

A staff (L) explains to a taxpayer about a new policy on VAT reduction at a local tax bureau in Fengze district of Quanzhou, East China’s Fujian province, April 1, 2019.[Photo/Xinhua]

Staff members help citizens with taxpaying at a local administrative service center in Huancui district of Weihai, East China’s Shandong province, April 1, 2019.[Photo/Xinhua]