The nation’s top leaders pledged on Dec 16 to balance stable growth and risk prevention as they wrapped up an annual tone-setting meeting that mapped out economic policies for next year.

“Maintaining stability while seeking progress” will be an important principle for China’s economic work next year, said a statement from the three-day Central Economic Work Conference.

The meeting agreed that China’s economic policy stance will remain largely stable next year. It said that China will maintain a prudent and neutral monetary policy and a proactive fiscal policy in 2017.

The nation should maintain an appropriate growth range and try to prevent risks in key areas, according to the statement.

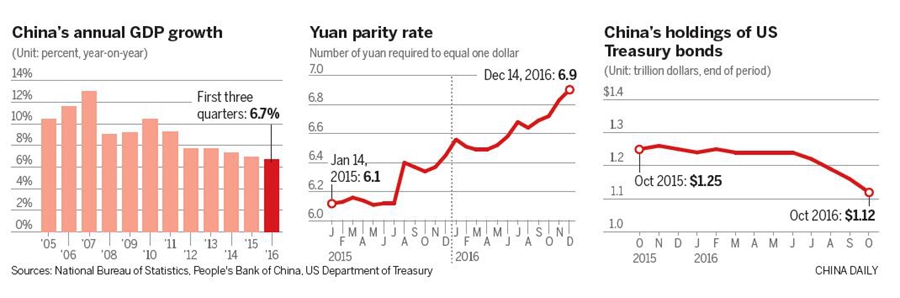

The country also should continue to push forward supply-side structural reform aimed at cutting excessive capacity and lowering the tax burdens on enterprises, and keep liquidity and the yuan basically stable, it said.

“A stable policy environment, including a stable currency, provides a foundation for stable economic growth,” said Dong Yuping, an economist at the Chinese Academy of Social Sciences.

Participants agreed that attention should be paid to prevention of financial risks.

Asset bubbles should be put under control and regulatory capacity should be improved to prevent systematic financial risks.

“China’s stock, bond and currency markets all experienced huge fluctuations recently, which means financial risks have become more apparent,” Dong said.

The nonperforming-loan ratio for banks is rising and capital outflows have increased. Therefore, the government must focus on financial risk prevention while trying to stabilize growth, he said.

China should keep its real estate market stable and healthy, as “properties are for residential use, not speculation”, according to the statement.

A market-oriented and long-term mechanism should be established that can curb a real estate bubble and prevent erratic fluctuations, it said.

Local governments will be held accountable if prices rise too high, it said, adding that the land supply should be increased to ease price rises.

Niu Li, an economist at the State Information Center, said that in the first 11 months of the year, about 45 percent of the country’s new yuan lending was used by residents to buy properties, compared with about 25 percent in previous years.

The statement also said the government should increase the confidence of private business owners by strengthening property rights protection.

It also said China should deepen reform of State-owned enterprises, and “substantial progress should be made in some areas, such as power, oil, natural gas, railway, civil aviation, telecom and the military industry”.