China’s online tourism sector is witnessing a boom, and firms in the business are growing rapidly, on the back of Chinese wanderlust.

To exploit the emerging opportunities, online travel agencies or OTAs are offering new, customized products and services.

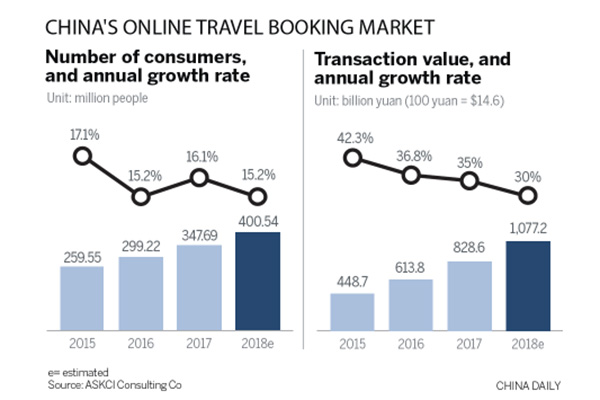

They are encouraged by the fact that in 2018, the market scale of OTAs reached 1.08 trillion yuan ($160 billion), adding 30 percent year-on-year, hitting a record high, according to a report released by market consultancy ASKCI Consulting Co.

Last year, Chinese travelers spent $762 per person abroad, exceeding $276 spent by non-Chinese travelers. By 2023, Chinese travelers are expected to spend nearly $1,334 per person a year on overseas trips, according to a report released by the Chinese Academy of Social Sciences this month.

Sensing a maturing market, existing players have started consolidating or expanding their operations. In fact, the market itself is seeing a bit of restructuring as the number of players gets rationalized, with a few major firms set to dominate proceedings from now on.

Five OTAs hold the key to the fortunes of Chinese tourism as they command a collective 80 percent market share.

Ctrip is the big boy of the pack. In October 2015, it swallowed up Qunar, a travel firm that was beginning to find traction. According to consultancy Frost&Sullivan China, the combine of Ctrip and Qunar commands a more than 60 percent share of the OTA market.

Fliggy from the Alibaba stable, Tongcheng-Elong Holdings Ltd, which is backed by Tencent, and Tuniu Corp are the other three big players. Ctrip also holds stakes in Tongcheng-Elong and Tuniu.

Last year, Ctrip further extended its operations and expanded its distribution across the sector. Its total sales revenue jumped 30 percent over 2017 to reach 690 billion yuan, it said.

“By reinforcing their moats, industry leaders will become even stronger, and the sector will present a higher competition threshold, and the market centralization will become more obvious,” said Neil Wang, president of Frost & Sullivan China.

“The business model of the online travel sector in China boasts high gross profits and high user stickiness. Traditional offline travel agencies are seriously homogenized and their user stickiness is lower.

“In the future, more offline tourism businesses will turn to online operations, with an aim to achieve better integration and utilization of industry resources, and provide more convenient and efficient services to consumers.”

OTAs are setting up offline stores as well to expand their presence and attract more consumers. Ctrip said it plans to set up more than 8,000 physical stores nationwide, including in smaller towns and counties, this year.

“Chinese consumers are spending increasingly more money on services. Tourism is the mainstay of consumption of services. Tourism is becoming a main driver of China’s economic growth,” said Sun Jie, CEO of Ctrip, in an open letter in late December.

She said during the period of macroeconomic adjustment, the tourism industry can buck any possible slowdown by driving a trend of rapid growth. For, consumers are more willing to take a break and travel around the world. She said she is optimistic about the growth potential of the tourism industry in China.

Dai Bin, director of the China Tourism Academy, said Chinese tourists are seeking more diverse experiences while traveling abroad. Middle-class consumers, the core group of the outbound tourism market on the Chinese mainland, are more willing to slow down the pace of life and enjoy in-depth and tailored travel experiences, encouraged by their growing spending power and evolving tastes.

“More Chinese travelers prefer independent and flexible trips, instead of traveling with tour groups. Besides, those who spend a lot of money shopping account for only a small portion of the total now, and more people are willing to experience local events, food and culture,” he said.

This trend, however, has created certain challenges for OTAs. Rapid growth has led to shortage of skilled manpower. Qualified tourism professionals are few and far between.

To customize tours as per travelers’ needs and preferences, OTAs need skilled professionals with a penchant for creativity or imagination, comprehensive knowledge of visit-worthy places, and good interpersonal vibe, besides traits like patience, customer service outlook, and ability to read, write and speak multiple languages well.

Wang of Frost & Sullivan said tourism professionals also need to provide guidance proactively, help with bookings, and deal with sudden changes in travel plans or itineraries-all with an intent to create rich tourist experiences, complete with local lifestyle events.

“Travel customizers need to master professional knowledge, foreign language skills and good service literacy. At this stage, professionals with comprehensive abilities are quite scarce in the sector,” he said.

OTAs also lack a mature supervision mechanism. The government has yet to formulate corresponding laws and regulations for the customized tourism sector, which may result in varied service quality, Frost & Sullivan said.

To cater to the demand for tailored trips from Chinese consumers, Ctrip last year introduced overseas chartered car packages. These included specially designed tailored tours for travelers, especially for young parents with small kids.

Besides, all of the chartered cars are aged between 3 and 5 and free of mechanical problems, and are equipped with safety seats for babies. “Compared with consumers who are more price-sensitive, families who travel with children usually consider more about safety and comfort,” said An Jing, director of overseas chartered cars services at Ctrip.

“The overseas chartered car market is increasingly favored by Chinese travelers, especially by those traveling with children. We will introduce more tailored services to meet more diversified demand from the market. Good-quality services that go beyond their expectations-they are the key to break through barriers in the fiercely competitive market,” she said.

Among the respondents that Ctrip surveyed, more than 80 percent of parents said as long as their children can have pleasant trips, they would not worry too much about prices.

Besides, 65 percent of respondents said chartered car services can help solve a lot of complicated transportation problems in foreign countries, and they are willing to try them.

Most Chinese families who travel with kids will opt for Japan and Southeast Asian countries as their top destinations, given their proximity, relatively easier visa policies and similar cultures with China, Ctrip found.

In June, Ctrip found the number of bookings for its chartered car services surged three times year-on-year. It, however, did not disclose specific figures. Reservations that are related to family trips with children accounted for nearly 40 percent, Ctrip said.

In addition, Ctrip found that last year, among Chinese tourists who took first-class and business-class flights, consumers who were born in the 1980s and 1990s together accounted for 42 percent of the total.

Particularly, the number of passengers who were born after 2010 and took premium cabin seats surged over 80 percent, indicating that Chinese parents are more willing to spend money for better flying experience of their children, Ctrip said.