China’s GDP growth edged up in the second quarter, but officials and analysts foresee persistent downward pressure in the second half of this year.

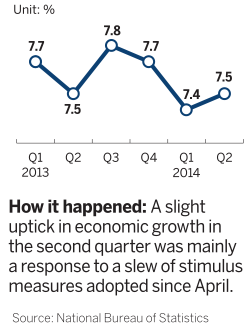

The economy grew 7.5 percent over a year earlier, slightly higher than the first quarter’s 7.4 percent, data released by the National Bureau of Statistics on Wednesday showed.

The market was little impressed by the data. The Shanghai Composite Index closed 0.15 percent lower while the Hong Kong H-share index fell 0.1 percent.

“The 7.5 percent growth is what I had predicted,” said Xu Gao, chief economist with Everbright Securities. “That does not mean we can stop worrying, because downward pressure will heighten in the second half. I think top leaders know this quite well and will do more to support the economy.”

The worry came from what will be a high base of comparison with the strong second half of 2013, and the property market’s continuous weakening.

“We cannot be blindly optimistic, because the current situation is quite complicated,” NBS spokesman Sheng Laiyun told a news conference.

“The traditional industries are in the middle of adjustments and such pains could continue for a while,” he said.

In a State Council executive meeting, Premier Li Keqiang said the government must ensure the economic growth target be met.

Growth in the second quarter was mainly a response to a slew of stimulus measures adopted since April, which included speeding up fiscal expenditure growth, infrastructure spending and, most important, monetary easing. M2, a broad measure of money supply, rose 14.7 percent by the end of June, compared with 13.4 percent growth by May.

The government measures have produced faster growth in industrial output, manufacturing activities, infrastructure investment and export, especially in June, all of which offset the negative impact of the property industry.

But this also stirred up concern whether the recovery is sustainable, especially if no new pro-growth measures are announced.

A report by the Bank of Communications said investment in infrastructure has to surge 26 percent to counterbalance the impact of the sagging property investment.

Gao Yuwei, a researcher with Bank of China’s Institute of International Finance, expected that the total money supply in the second half will not further loosen, as the priority of the central bank will shift toward taming the medium- to long-term interest rate.

NBS’s data also showed signs of rebalancing of the economy, something the government has long pursued. Tertiary industry’s share of the GDP rose to 46.6 percent, 1.3 percentage points higher than a year ago.

Total consumption contributed to 4 percentage points to the first half GDP growth of 7.4 percent, ahead of 3.6 percentage points from investment.