Many policies have been rolled out this year to cut taxes and reduce fees during the State Council executive meetings presided over by Premier Li Keqiang.

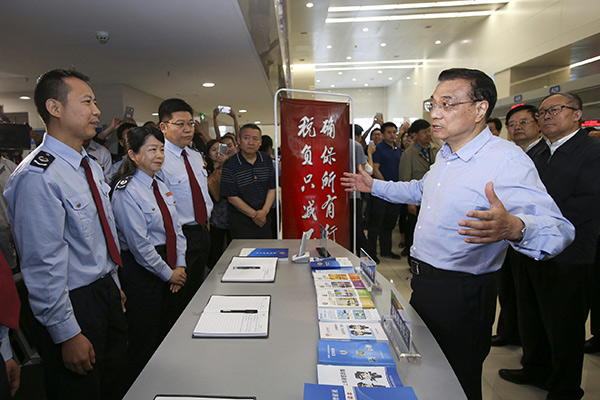

During a visit to a civic service center for the Shiyan city government in Hubei province, Premier Li reiterated that it should be ensured that tax burdens are reduced in all industries while implementing the value added tax (VAT).

At the March 8 executive meeting, it was decided to expand the VAT implementation to construction, real estate, the financial industry and the service industry starting in May. The State Council also asked local governments to ensure taxes are reduced in all industries.

The VAT implementation is expected to save enterprises over 500 billion yuan ($75 billion) this year.

At the executive meeting on April 13, a circular was released to reduce enterprises’ payment ratio of social insurance and deposit rate of the housing accumulation fund.

Based on the circular, related departments carried out measures to reduce the payment ratio of basic pension insurance by enterprises and the unemployment insurance rate, and set ceilings on the housing accumulation fund deposit ratio.

It is estimated that enterprises will save 100 billion yuan each year by the reduction.

At the executive meeting on Jan 27, it was decided to cancel a series of fees collected for government-controlled funds starting in February.

The efforts include lowering the standards for the new vegetable field development fund and the forestation fund to zero, and expanding the scope of taxpayers on exemption of education surcharges and water conservancy construction fund.

It is expected to ease enterprises’ burden of 26 billion yuan.

On April 28, the Ministry of Finance and the National Development and Reform Commission (NDRC) issued a circular to exempt all enterprises and individuals from 18 administrative undertaking fees, which took effect beginning May 1. This exemption involves administrative fees charged by agricultural, quality supervision and forestry departments.

On Dec 30, 2015, the NDRC released a circular to reduce the price of coal-fired electricity and general industrial and commercial sales electricity. The price would be cut by an average of 0.03 yuan per kilowatt-hour from Jan 1, 2016, according to the circular. Large-scale industries would continue to pay the same price for electricity.

Currently, the NDRC is planning to further cut electricity prices. In the second round of reduction, the price for general industrial and commercial sales electricity will be cut by 0.0105 yuan per kilowatt-hour, and the price for large-scale industries will be reduced by 0.011 yuan per kilowatt-hour. The price cuts are expected to reduce around 47 billion yuan in electricity costs for industrial and commercial enterprises.

To further reduce business operating costs, the NDRC and the People’s Bank of China decided to improve the pricing mechanism for bank card swiping charges, aiming to significantly lower the service fees. The adjusted policy on bank card swiping charges will be officially implemented on Sept 6. This policy adjustment mainly covers the following aspects: reducing the service fees of issuing banks; lowering service fees of online transactions; adjusting the capping and control measures for service fees; offering preferential service fee rates for some businesses; and subjecting service fees of acquiring banks to market regulation.