China’s private companies have taken the lead over State-owned enterprises in the country’s surging outbound investment for the first time, a government report said on Sept 22.

Private enterprises are leading in both the amount invested and the number of mergers and acquisitions abroad, officials said.

The change has taken place as outbound direct investment surpassed foreign direct investment last year, also a new phenomenon.

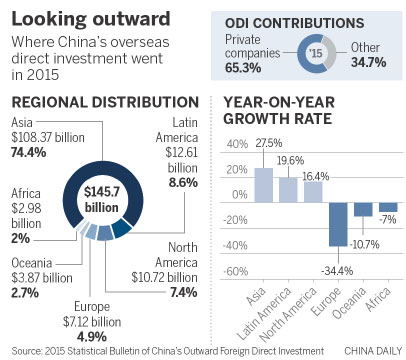

Private companies account for 65.3 percent of the total ODI, which amounted to $145.7 billion by the end of last year, according to the 2015 Statistical Bulletin of China’s Outward Foreign Direct Investment.

Meanwhile, ODI surged by more than 18 percent last year, exceeding the $135.6 billion in foreign direct investment, said the report, jointly issued by the Ministry of Commerce, the National Bureau of Statistics and the State Administration of Foreign Exchange.

“The private companies have really become an important force in driving the growth of outbound investment,” said Zhang Xiangchen, deputy international trade representative at the Ministry of Commerce, at a news conference. Private deals account for 75.6 percent of the total amount of overseas acquisitions, Zhang added.

Huge, privately owned companies that are on a foreign shopping spree to either upgrade their technology or diversify their business are behind the shift.

One frequent shopper, Chinese aviation and shipping conglomerate HNA Group, bought total foreign assets worth at least $17 billion last year.

This year, the private enterprise advanced its global expansion ambitions with additional acquisitions that included a 13 percent stake in the airline company Virgin Australia Holdings, with an investment of $114 million.

Even though State-owned enterprises still have a competitive edge over their private peers in such highly regulated industries as electricity, energy and mining, that has not dimmed the enthusiasm of private companies for overseas growth.

Wang Huiyao, director of the Center for China and Globalization in Beijing, said that private companies tend to be flexible and able to respond quickly to the changing environment overseas.

“The private sector contributes more to ODI because the sector itself is growing and getting larger. Meanwhile, the national anti-corruption campaign has slowed the State sector’s process of going global, because those enterprises have to adjust their strategies due to the introduction of new executives and leaders,” he said.

As Chinese companies spend more overseas, the government is taking more measures to ensure the security of assets and the growing number of Chinese working abroad, which already has reached 1 million, said Zhang of the Commerce Ministry.

“We are producing guides to foreign investment and risk assessment reports every year to assist Chinese investment in guarding against risks,” he said. “We are also encouraging Chinese investors to bolster their risk management abilities and buy insurance in case of losses or damage,” he said.