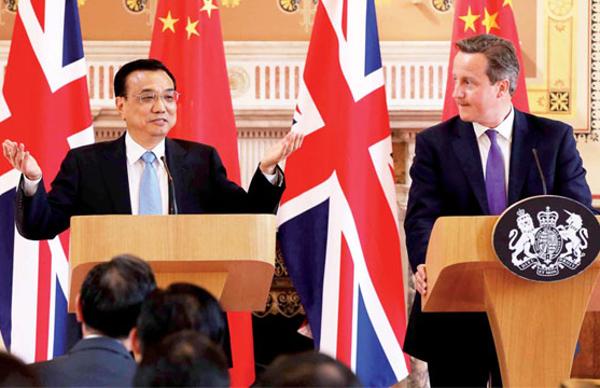

Premier Li Keqiang and British Prime Minister David Cameron meet the media on June 17, 2014.[Photo/Xinhua]

Financial collaboration, clean energy and infrastructure at forefront in Li visit

After two years of ups and downs in relations between China and Britain, Premier Li Keqiang ended a visit to the country after signing deals on investment, trade and business collaboration worth $30 billion (22 billion euros). Li presided over the signing with Britain’s Prime Minister David Cameron in London on June 18.

While such deals are common in such high-level visits, these ones stand out because they focus on finance, clean energy and infrastructure.

Li underlined the importance of financial cooperation between the two countries several times.

At the first China-UK Financial Forum, also on June 18, he urged Britain to seize the chance to consolidate its place as one of the most important offshore yuan markets outside Asia.

“China is an emerging major financial country, and its financial development and reform is underway, while the UK, as a well-established financial power, has very open and vast and time-honored financial markets and institutions. We have much to offer each other.”

Britain’s Chancellor George Osborne, who appeared alongside Li, said the increasing importance of the yuan could lead to a historic shake-up of the global financial system, and said he wants Britain to play a central role.

“I believe the emergence of China’s currency as one of the world’s leading currencies will be the next huge change (to the financial world),” Osborne said.

The forum heralded direct trading between the British and Chinese currencies for the first time. China’s central bank, the People’s Bank of China, said the yuan will be traded directly against sterling in the interbank foreign exchange market.

It is the latest step in facilitating investment and bilateral trade between China and Britain.

The bank said: “The move will help lower foreign exchange conversion costs and will promote use of both the yuan and pound in bilateral trade and investment, which will help strengthen financial ties between the two countries.”

The British pound will become the fifth major currency that can be traded directly with the yuan in Shanghai, joining Australian and New Zealand dollars, the Japanese yen and the US dollar.

Li also hailed a deal that makes China Construction Bank the first clearing-service provider for offshore trading of yuan in London.

He told businesspeople on June 17: “It will further consolidate and promote London’s status as an international financial hub and will help the gradual internationalization of renminbi to promote trade and investment liberalization and facilitation.”

Industry insiders say that together with the direct trade of the yuan and the pound, financial cooperation between China and Britain will boost internationalization of the yuan, and will add weight to London’s efforts to become the yuan’s European offshore hub, faced with competition from Frankfurt, Luxembourg and Paris.

Mark Boleat, policy chairman at the City of London Corporation, said: “We welcome the designation of the clearing bank of offshore renminbi trading in London, which is the first officially named clearing bank for renminbi trading outside Asia and further strengthens London’s position as a leading offshore RMB center.

“It will empower London with enhanced access to renminbi liquidity in China, allowing London to continue to develop effectively to meet the demands of the growing renminbi European market and befitting the world’s largest center for foreign exchange.”

Li said he hopes the financial cooperation shows the way for collaboration between China and Britain in other spheres.

The Bank of China signed an agreement with the London Stock Exchange on June 17 to develop offshore trading in the yuan.

“In London, the world’s biggest foreign exchange trading center, renminbi trading has taken up two-thirds of the global market, excluding the Chinese mainland and Hong Kong,” said Tian Guoli, chairman of the Bank of China.

The state-owned China Development Bank also signed an agreement, with TheCityUK, a private financial services association.

The agreement will encourage China Development Bank lending in Britain as well as trading in the yuan, which will open up trade opportunities in China to British businesses.

And China Minsheng Investment Corp, China’s largest private investment group, with capital of $8 billion, announced it was opening its European headquarters in London with an investment of about $1.5 billion.

While financial cooperation played a big role in Li’s visit, clean-energy projects dominated all the deals.

The oil company BP signed an agreement worth $18 billion to provide China National Offshore Oil Corp with liquefied natural gas for 20 years, starting in 2018.

Royal Dutch Shell announced a global alliance with CNOOC to bolster an already strong relationship. It includes three production-sharing contracts in the Yinggehai Basin in the South China Sea. Shell is also working with PetroChina to produce shale gas in China.

The energy deal will give a fillip to China’s efforts to reduce reliance on coal and to improve air quality, experts say.

It is expected that China’s liquefied natural gas imports will rise by at least 1.5 million tons a year.

China has ambitions to increase imports of natural gas, in part to reduce its reliance on coal, thus improving air quality in big cities.

Last month China clinched a $400 billion, 30-year gas supply deal with Russia.

Li and British leaders also discussed Britain’s need for investment in its multi-billion-pound infrastructure projects.

Under a framework agreement, Britain will welcome Chinese firms taking part in a planned high-speed rail network, a 42 billion pound ($71.2 billion; 52.5 billion euros) project, with the first 192 km stage linking London and Birmingham, in the Midlands.

The two sides are to discuss high-speed rail standards, key technologies and equipment. It will be a milestone for Chinese high-speed rail companies to export technology to Britain, which built the world’s first railway in 1825.

Zhao Jian, a professor of transport economics at Beijing Jiaotong University, said: “China has mature technologies and an excellent record of building railways. It has built thousands of kilometers of railway lines in various climatic conditions.”

A memorandum of understanding was signed between the Department for Transport and China’s National Development and Reform Commission committing the countries to “business co-operation in the rail sector”.

China boasts the world’s longest high-speed rail network, of more than 11,000 km.

Zhao said the framework agreement is the initial stage of a much larger cooperation plan.

“China may take part in more projects across Europe, especially in the east.”

A high-speed rail line planned in Romania using Chinese technology and financing is being discussed in the European Union, China Securities Journal reported.

Britain also welcomes Chinese investment in the Hinkley Point project in southwestern England, the country’s first nuclear power station in two decades.

There was also an agreement between the Chinese Atomic Energy Authority, the Chinese National Nuclear Corporation and the Department of Energy on “nuclear fuel cycle supply chain collaboration”.

Separately, Rolls-Royce said it had agreed to work more closely with China’s State Nuclear Power Technology Corporation on civil nuclear power.

The agreement builds on the Chinese nuclear industry’s increasing interest in atomic energy in Britain, a trend both governments support.

“China represents one of the world’s largest civil nuclear markets, in which Rolls-Royce has been supplying safety-critical technology and solutions for 20 years,” said Jason Smith, president of Rolls-Royce’s nuclear division.