Premier Li Keqiang inspected the State Administration of Taxation (SAT) and the Ministry of Finance (MOF) on their progress regarding the replacement of the business tax with a value-added tax (VAT) on April 1. The Premier also held a symposium on this work after his inspections.

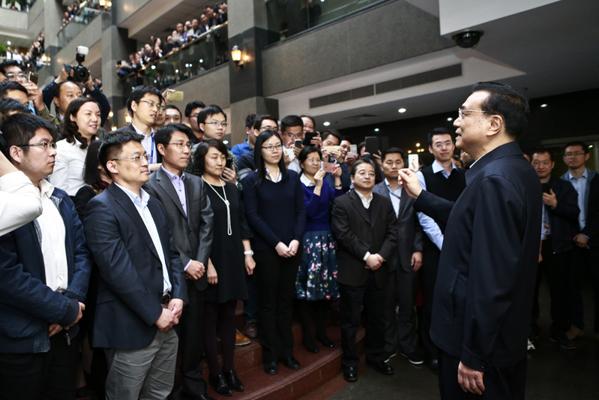

At the SAT, Premier Li Keqiang inquired about the changeover’s progress and information related to the tax management information system. He said that replacing the business tax with a VAT will involve more than 10 million taxpayers in four newly-added industries: construction, real estate, finance and life services. The purpose of this reform is to bring benefits to enterprises that will invigorate market vitality, the Premier said.

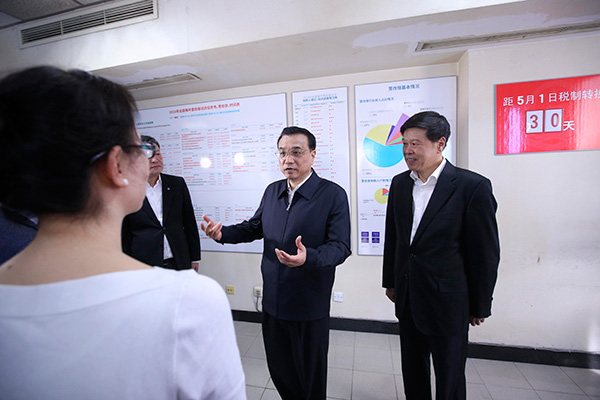

In both the SAT and the MOF, the Premier carefully asked about the taxation change in the sectors where the reform was implemented.

The Premier stressed that replacing the business tax with a VAT will be key to promoting structural reform, especially supply-side reform, this year. He urged governments at all levels to learn from the pilot projects’ experiences and to make every effort to work on the reform. “We will ensure the tax reduction, as said in the government work report,” the Premier said.

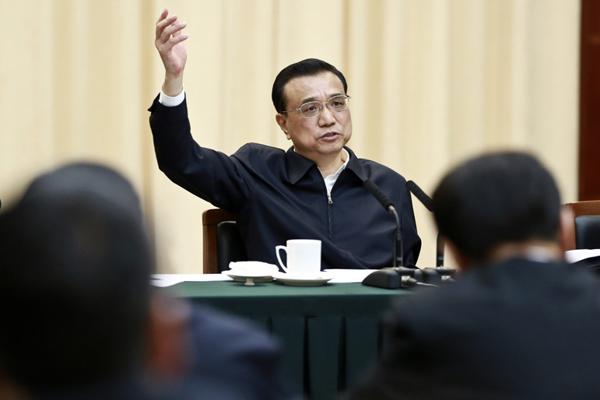

At the symposium, leaders form SAT and MOF made reports on the work involved in replacing the business tax with a VAT. Leaders from other ministries, including the Ministry of Housing and Urban-Rural Development and the Ministry of Transport, also delivered speeches.

The Premier affirmed the contributions that the tax staff has made in promoting the replacement of the business tax with a VAT. He said this work is an important measure for both structural reform and taxation reform. The policy will be conducive to the following:

First, it will ease the taxation burden on enterprises. Premier Li said the active fiscal policy will play a bigger role under economic downward pressure. This year’s tax cut will be the biggest in recent years. A total of over 500 billion yuan will be reduced after this reform, the Premier said.

Second, it will boost economic upgrading and transformation. Policies on replacing the business tax with a VAT will focus on promoting the development of the service industry, which can promote industrial division and optimization and driving upgrades in the manufacturing industry, the Premier said.

Third, the policy will avail creation of a fair market environment by unifying the tax system and eliminating overlapping taxation, which is of great significance for improving China’s fiscal and tax system.

Premier Li noted that the development of the new economy and the cultivation of new momentum breed the development of new technology, industry and business models. The full implementation of replacing the business tax with a VAT will help to lower the cost of innovation for enterprises, promote equipment upgrades and provide a wider space for mass entrepreneurship and innovation.

It also will be helpful to create a relaxed environment for private economy and small-and micro-businesses, boost employment and maintain medium-to-high speed growth.

Premier Li urged an all-out effort with a craftsman’s spirit in preparing the full operation of the policy. Departments also are urged to cooperate to form a coordinated effort to interpret policies, respond to social concerns and stabilize market expectation. He also called for stepping up related training for taxpayers, helping enterprises to understand policies and improving financial management.

Meanwhile, the Premier urged mulling countermeasures over typical issues to ensure tax reduction rather than tax increases.

Lastly, he stressed improving the system and beefing up guidance to prevent regional protectionism, market division and a crackdown on tax dodgers.