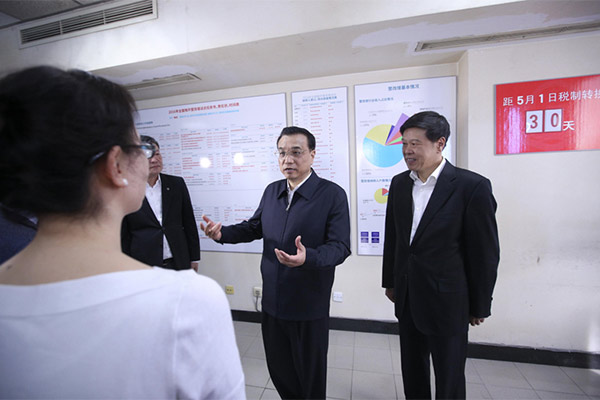

Premier Li Keqiang visits the State Administration of Taxation, April 1, 2016, Beijing.

Replacing the business tax with value-added tax is enhancing China’s economic potential amid the downward pressure.

Since last May, China has been implementing VAT reform across the nation, and Premier Li Keqiang stressed on many occasions that efforts must be made to ensure real tax reductions in all sectors.

The reform was both effective and efficient, as 500 billion yuan ($72.7 billion) in taxes were reduced for businesses across the nation.

The success drew attention and applause from international groups such as the Organization for Economic Cooperation and Development and Bloomberg.

Enterprises are fundamental components of the micro-economy and are essential to keeping stable economic growth and employment.

Even though international economic growth is slowing down and domestic economy is faced with downward pressure, China’s employment and income growth still made headway.

To some extent, the credit goes to VAT reform.

The most serious aftermath of economic growth drop are the collapse of the real economy, business closures, and family bankruptcies.

Therefore, keeping stable employment and enabling people to make money is a top priority. This is also the ultimate goal of economic development.

In general, employment increases depend on economic growth. But employment and incomes grew steadily, even as economic growth in the world’s second-largest economy was slowing down.

The explanation for the “economic paradox” is, according to international opinions, the efficient execution of China’s financial and tax departments, which not only lowered tax burdens for enterprises, but also promoted structural supply-side reform and encouraged mass entrepreneurship and innovation.

On the one hand, VAT reform offers a rehabilitation period for the nation’s enterprises against the backdrop of downward economic pressure, when running a business is not as easy as it used to be.

On the other hand, the reform stimulated mass entrepreneurship and innovation and optimized economic structure, especially in the service industry.

According to the Ministry of Science and Technology, China has 4,200 “maker-spaces”, which connect with more than 3,000 incubators and 400 accelerators of technology companies, offering services for more than 400,000 start-ups and creating nearly 1,000 stock-listed companies and 1.8 million jobs.

After VAT reform, the tertiary industry saw dramatic development as its ratio in social fixed investment rose from 52.6 percent in 2012 to 56.6 percent in 2015.

In addition, trials of the reform extended to finance, construction, real estate, and living services, adding 530,000 tax payers to the country.

All the data provides evidence that start-ups and medium- to small-sized companies are sensitive to taxes, and replacing the business tax with value-added tax will immensely expand their development potential.

It is also why this administration insisted on relieving 500 billion yuan in taxes for enterprises despite the downward economic pressure.

Cutting taxes for enterprises might reduce tax income, but it can help enterprises pull through economic difficulties, which is actually cultivating future tax sources, Premier Li once said about the reform.